tax on venmo cash app

Venmo is a digital wallet that makes money easier for everyone from students to small businesses. Join over 83 million people who use the Venmo app today.

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

More than 60 million people use the Venmo app for fast safe social payments.

. Boasting millions of users CashApp is a convenient way to send money. GET REWARDED WITH THE VENMO C. Venmo is the fast safe social way to pay and get paid.

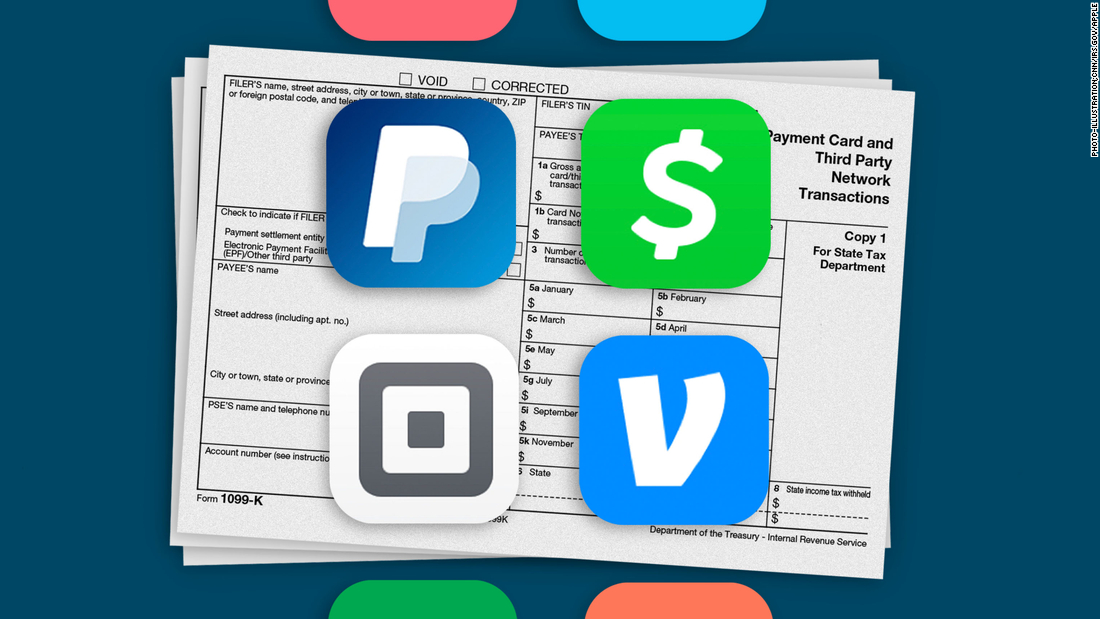

1 mobile payment apps like Venmo PayPal Zelle and Cash App are required to report commercial transactions totaling more than 600 a year to the IRS. Those posts refer to a provision in the American Rescue Plan Act which went into effect on January 1 2022 according to which anyone receiving 600 per year using Venmo PayPal Zelle or Cash App will receive a 1099-K and be required to report that income on their taxes. As of Jan.

Sign in to your Cash App account. View transaction history manage your account and send payments. Cash App and Venmo are widely used peer-to-peer P2P mobile payment apps.

A lot of the free tax services will make you fill it all out then at the end will say you grossed over 60000 this. Scams on Cash App include fake money requests asking innocent users to accept stolen money or overpayment scams where the scammer closes their bank account before the funds transfer back to you or use a stolen. 1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service.

Fee-free tax filing through Cash App Taxes. But also a method that scammers may ask for funds through. This new regulation a provision of the 2021 American Rescue Plan now requires earnings over 600 paid through digital apps like PayPal Cash App or.

SEND AND RECEIVE MONEY Pay and get paid for anything from your share of rent to a gift. Add a note to each payment to share and connect with friends. Help protect all of your payments and investments with a passcode TouchID or FaceID.

Cash App is the easy way to send spend save and invest your money. Both allow you to send and receive money from your smartphone. The new reporting requirement only applies to sellers of goods and services not.

Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle Cash App or Venmo. Under the American Rescue Plan Act people who sell goods or services on platforms like Etsy eBay and other sites that use third-party transaction networks like PayPal Cash App and Venmo will be issued a tax form called a 1099-K for online sales totaling 600 or more starting next year. Under the American Rescue Plan Act people who sell goods or services on platforms like Etsy eBay and other sites that use third-party transaction networks like PayPal Cash App and Venmo will be issued a tax form called a 1099-K for online sales totaling 600 or more starting next year.

The taxes dont apply to friends and family transactions like rent. Current tax law requires anyone to pay taxes on income over 600 regardless of where it comes from. Its the SAFE FAST and FREE mobile finance app.

New Tax Law Venmo Cash App To Report Business Transactions Over 600 Wrvo Public Media

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wsiltv Com

Venmo Cashapp And Other Payment Apps Face New Tax Reporting Rule Cnn Business

New Tax Law Irs Wants To Tax Cash App Venmo Zelle Transactions Small Business Princedonnell Youtube

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You

Cash App Vs Venmo How They Compare Gobankingrates

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You 6abc Philadelphia

Does The Irs Want To Tax Your Venmo Not Exactly

Tax Law Changes Could Affect Paypal Venmo And Cash App Users

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

3 Ways To Avoid Taxes On Cashapp Venmo Paypal Zelle Legally Youtube

Nowthis If You Are Doing Business With Your Clients Using Third Party Apps Like Cash App Paypal Venmo Or Zelle You Should Know That The Irs Will Soon Require Businesses To Report

Tax Changes Coming For Cash App Transactions

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You 6abc Philadelphia

Will Users Pay Taxes On Venmo Cash App Transactions It Depends

Startchurch Blog New Tax Rule What Churches Must Know About Paypal Venmo And Cash App Changes

New Irs Rule Requires Paypal Cashapp To Report Payments Over 600